|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Negative Equity: Strategies and Solutions for HomeownersOwning a home is a dream for many, but sometimes, market fluctuations and financial challenges can lead to negative equity, where the value of your home drops below the outstanding mortgage balance. Refinancing can be a viable solution in such situations, offering homeowners a chance to stabilize their finances. Understanding Negative EquityNegative equity, also known as being 'underwater' or 'upside down,' occurs when the real estate market declines, leaving homeowners with a mortgage larger than their property's current market value. This can be distressing, but there are strategies to manage this situation effectively. Common Causes

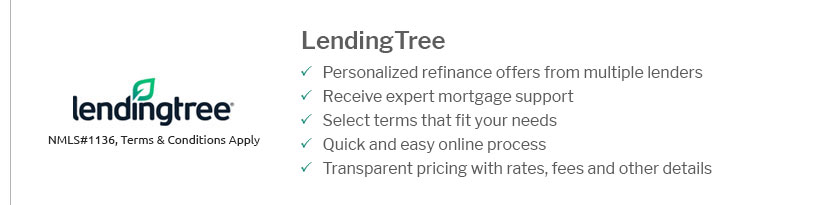

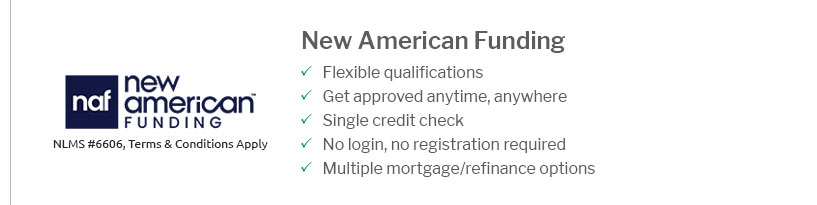

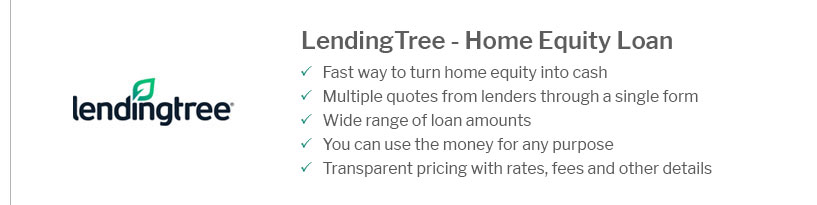

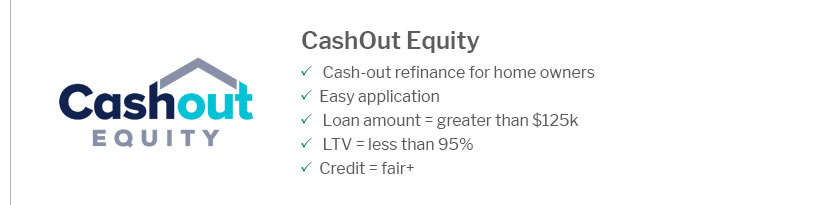

Effects on HomeownersBeing in negative equity can limit your financial flexibility and options, particularly when it comes to selling your home or refinancing your mortgage. Refinancing Options for Negative EquityDespite the challenges, there are refinancing options available for homeowners dealing with negative equity. Here are some popular strategies: Government ProgramsSeveral government-backed programs are designed to assist homeowners in negative equity. These can include lower interest rates or more favorable terms. Finding the Best RatesResearching the best refinance rates 10 year fixed can provide homeowners with opportunities to secure better terms, potentially reducing monthly payments and improving overall financial stability. Private Lender SolutionsMany private lenders offer specialized refinancing products for those with negative equity. Consulting with financial experts can help you identify the best place to refinance your house and evaluate these options. Benefits of Refinancing in Negative Equity

FAQCan I refinance my home if I'm underwater?Yes, it is possible to refinance even if your home is underwater. Various government programs and private lenders offer refinancing options for homeowners in this situation. What are the best programs for refinancing with negative equity?Government programs like HARP (Home Affordable Refinance Program) have been popular, though availability and options may vary. It's essential to research current offerings and consult with financial advisors. Is it beneficial to refinance now or wait for the market to improve?The decision depends on your current financial situation and future market expectations. If you can secure a lower interest rate now, it may be beneficial to refinance rather than wait. https://www.reddit.com/r/REBubble/comments/vim5th/the_amount_of_people_who_dont_understand_that_you/

you can absolutely refinance with negative equity. You will just have to write a check for the difference to get to 80pc LTV. https://www.bankrate.com/home-equity/what-is-negative-equity/

Negative equity occurs when your home's value sinks below the amount you owe on it (from your mortgage or other home loans). - Having negative ... https://www.rocketmortgage.com/learn/negative-equity

Negative equity means you owe more on your mortgage loan than the current value of your home. When property values fall, you may be left with no equity.

|

|---|